Downsizing to a smaller home has a number of benefits and downsides that often relate to your finances, family or freedom. However, we wanted to understand exactly why the great British public was choosing to sell up and move into a smaller property.

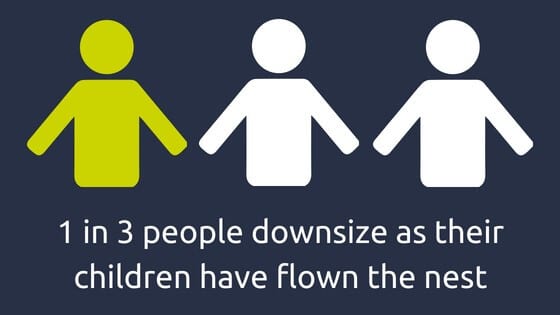

Research conducted by WeBuyAnyHome analysed the downsizing reasons of 2,501 UK citizens. Data revealed three key reasons why the majority of sellers downsize. 16% of respondents cited divorce or separation as their reason for downsizing, and a further 21% put their house sale down to retirement. However, the vast majority – 1 in 3 people – said they chose to downsize as their children had flown the nest.

3 reasons for downsizing your home

Breaking down and analysing the data in terms of men and women revealed the same trend, the top three reasons to downsize are:

- Divorce,

- Retirement

- Children leaving home

Interestingly, 1 in 9 men revealed they downsized to reduce debt. Similarly, 1 in 9 women downsized to reduce their mortgage payments.

Unsurprisingly, across all age demographics, the same core three reasons typically reigned supreme. However, for the 25 to 44 age bracket retirement was replaced with 14% of respondents downsizing due to serious debt. 1 in 5 of this age group also noted that their primary reason for selling up was after a divorce or separation.

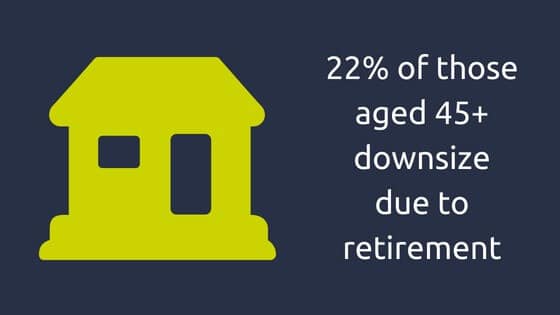

For those aged 45 and over the core three reasons for downsizing followed the general trend:

- 16% downsized due to divorce or separation

- 22% due to retirement

- 37% because no children remained at home

Reasons not to downsize

For many, downsizing isn’t a proposition that is chosen. Often with divorce or retirement, downsizing is a necessary action that is sometimes out of your hands. However, whilst downsizing inevitably frees up cash and allows you to manage your finances, there are some disadvantages you should keep in mind before selling up.

- Fewer belongings

Moving to a smaller property will mean you can’t take everything with you. Some people opt to put belongings into storage whereas some revel in the opportunity to have a serious clear out. Whilst it can be hard to let go of some things, you will be thankful in the long run.

- No room for guests

Whereas before Christmas may have been hosted at your house or you were used to laying on birthday dinners, after downsizing things may have to change. However, if your children have left home to start their own families perhaps it is time for the baton to be passed to them?

- Lifestyle changes

You will have become accustomed to a certain way of life and many associate larger houses with social prestige. Change is unsettling, but downsizing should be seen as an opportunity for a clean slate as opposed to something to be feared.

5 reasons why we shouldn’t be afraid of downsizing

With Kristin Wiig and Matt Damon taking the concept of downsizing pretty seriously in their upcoming cinematic debut, the subject is well and truly on everyone’s lips.

Downsizing has long had negative connotations; from the upheaval of moving, to the worry of losing out on some of the home comforts you’ve become accustomed to, the whole process can feel like admitting defeat.

For many, downsizing can feel like something of an identity crisis. Often downsizing comes after years spent in a home, a place that holds happy memories and significance for its owners.

However, downsizing need not always been an unhappy process. Here’s why:

- Own less, save more

Reducing the size of your living accommodation also reduces the size of your bills. Smaller properties often cost less in terms of gas and electricity which in turn will take the pressure off your monthly outgoings. All good news so far…

- De-clutter, de-stress

A move to a smaller property can be a great opportunity to rid yourself of the unwanted clutter that we are all guilty of accumulating when living in one property for years. Try to see this as a golden opportunity to get rid of items that have been quietly gathering dust, and to re-assess what is the most valuable to you. You might even re-discover some lost treasures that have been lost at the back of a storage cupboard.

- Free up some income

Selling your larger property in favour of a smaller property could mean that you generate extra income that you weren’t expecting. You could reap the benefits of your built-up equity and release assets as you downsize. If this is the case you could use this money to pay off some of your new property or even put it towards a well-deserved holiday.

- A fresh start, fresh design

Chances are when you bought the last property you had a completely different tastes and requirements for your home than you do now. Perhaps you bought your larger property to accommodate children who no longer live with you? Or perhaps you had several pets that required a large outdoor space that now feels more of a burden than a luxury. See this as an opportunity to choose a house that perfectly fits your requirements. However much you love your current property there will certainly be niggles that you could use this move to rectify.

- Less maintenance

It’s a simple fact that a smaller property requires less upkeep. From cleaning to repairs, the demands are significantly decreased when you downsize which means you can spend your time doing things you’d much rather do!

For whatever reason you may have for moving to a smaller home, We Buy Any Home can give you a cash offer for your current house within 7 days. If you’re looking to downsize but are struggling to sell your property, our expert team are on hand to help. Simply get in touch via the form below and we will be in touch. We are experts in selling houses fast!