When selling a house everybody wants two things; an easy way to sell your house fast and to receive the full asking price. Unfortunately for most people, this is not achievable, with selling a house often becoming a demanding process that appears to take forever.

In a similar vein to other industries, the property market is based on the simple economic equation of ‘supply and demand’. These two factors can impact both the price of a property and the time it spends on the market. The supply and demand of property vary drastically across the UK, with some regions experiencing a far more competitive market than others. It will come as no surprise that the supply and demand of property in London are not harmonious, with people frantically searching through the capital’s more affordable properties and battling it out at the offers stage.

However, even with demand through the roof for London properties, there are houses which aren’t flying from the estate agent’s windows as quickly as others.

How long does it take on average to sell a property in London?

It is estimated to take around 126 days to sell a property in London, with that timeframe increasing by 11% every year.

On a broader note, 2 to 3 months. However, it is important to note that it is not always the case. Some properties sell much faster, some take far longer. In comparison to the rest of the UK, it is often assumed that the turnover of properties in the capital is extremely fast. However, as already mentioned, this is generally untrue. When looking into the average selling time by region, London, alongside Liverpool and Newcastle take the longest. The average time across the country is between 9 and 11 weeks, with the fastest region to sell being the East Midlands, with an average time of 8 weeks. It is this time frame that makes many people consider the use of cash house buyers.

Price of properties in London

When trying to sell property in London, you cannot use the rest of the country as a comparison. Due to how competitive the market in London is, property reacts completely differently to change and competition.

Property prices are incredibly important in determining how long a property will spend on the market. When prices are high in certain areas, customers are more likely to bide their time and explore the different avenues available to buyers, namely whether it is better to rent or buy. Although the demand is strong within London, the average property prices raise questions of affordability; it is understandable why the average selling time is a month longer than the rest of the country.

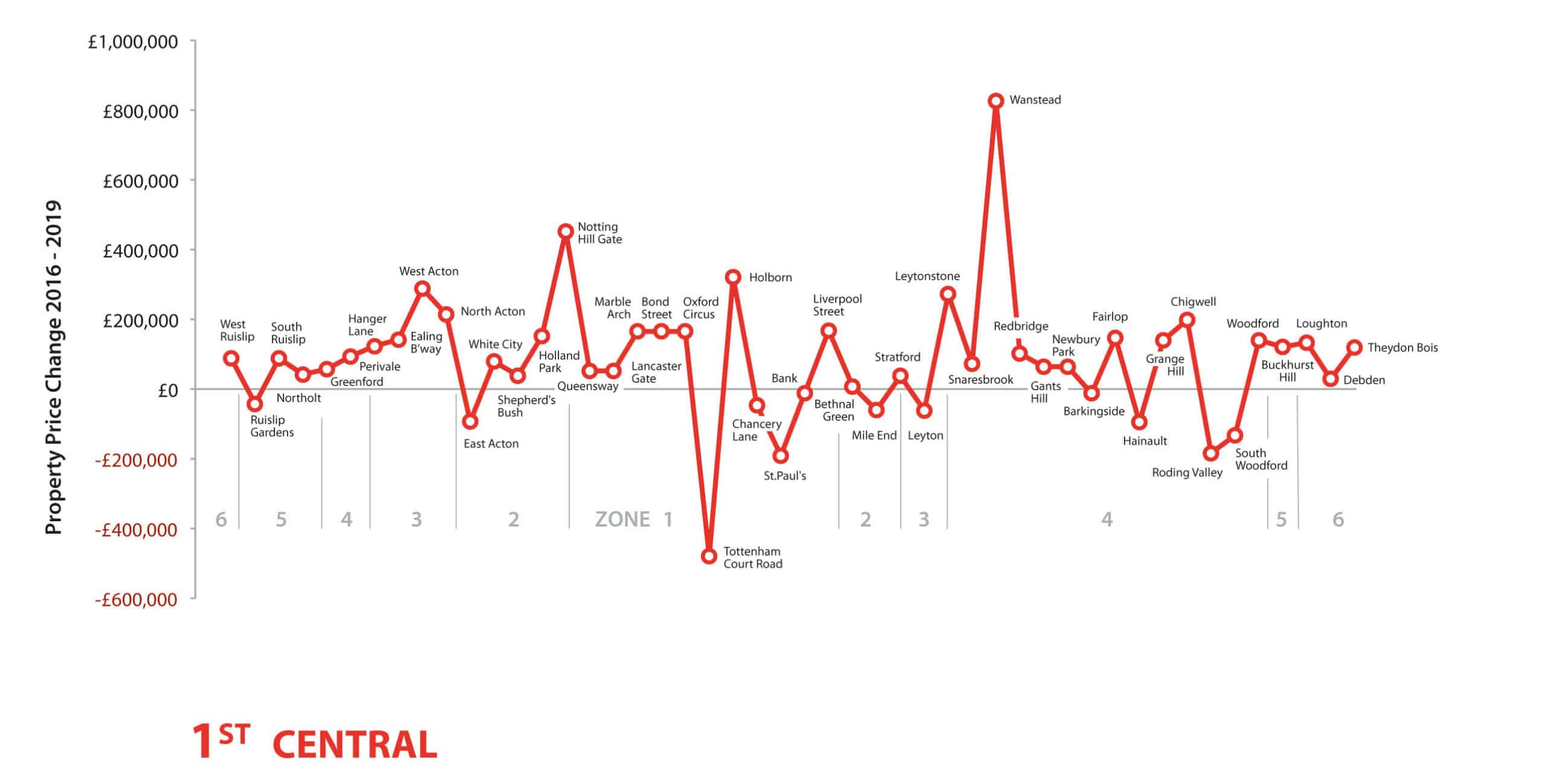

In comparison to the rest of the country, London prices on average are far more expensive and have witnessed substantial increases in the recent few years. In just three years the Central Line has seen the largest average property price increase, skyrocketing £85,160 from £686,000 in 2016 to £771,160 this year.

How is your area performing?

To understand why your property in London may not be selling, it is critical to know how the capital’s market is performing currently. Sold.co.uk recently revealed their interactive map of London house prices. With the London Underground acting as the backbone of life in the capital, Sold.co.uk took the savvy approach of plotting the average property prices by the tube station. Through using this tool, you can gain a clear understanding of how well an area is performing.

Their extensive research and data collection revealed an interesting insight into London’s property market. The Circle line running around central London has by far the most expensive property prices across London, however, this is expected given some the areas it operates through. With 51% of average house prices on the Circle Line above £1million, the entire 36 stations on the line do not have a location cheaper than £501,542- with High Street Kensington recording the highest price of over £3million.

It is important to note that the majority of all lines run through areas which have property prices into the millions. Although the majority of these are located around Central London Boroughs, areas such as Richmond and Wimbledon are seeing prices rise to close to a million pounds, with some more central locations around Vauxhall, Borough and Brixton recording more affordable prices of around £500,000.

With many areas recording average house prices in the millions, other areas are seeing far more substantial price increases, especially since 2016. This is the case with the Central line: running through more residential areas, the attraction of living within these is on the rise. Coupled with running through some of the busiest stations like Oxford Circus and Bond Street, the Central line has great connections across London.

Brexit uncertainty

The 2019 property market in London has thrown up some significant surprises. Although the city has recorded a substantial price increase in recent years, the uncertainty around Brexit has had a negative effect on the market this year. Property prices have experienced a fall of 2 to 4% depending on what area you are looking at and the average house prices across the whole city were affected. Due to the nature of the market in Central London, the uncertainty of Brexit caused greater ramifications. This was clear with the borough of Westminster experiencing a fall of around 14.03%, with Camden falling by 8.25%.

What does this mean?

When uncertainty hits the property market, it creates clear winners and losers. As mentioned, the Brexit uncertainty has caused a fall in prices, which has created a promising market for those looking to buy. With lower prices, it means the money goes further when buying a property. On the other hand, those looking to sell will have to accept lower asking prices than previously expected.

Although you may be eager to sell, some properties are more affected by this than others. The areas that tend to be more popular with families and first-time buyers, who are less likely to alter their plans based on Brexit, then those with more expensive properties in central London. When selling a property, you must weigh up the financial pros and cons, although you may be pushing for your property to sell, you need still need to gain the most out of it.

If you are thinking of selling, or are in the process of selling, you need to ask whether this is the right time to sell. Alternatively, if you want to ensure that your house sells, why not consider an alternative avenue to the traditional estate agent and contact WeBuyAnyHome? Get a cash offer for your home from us today and we could have your property sold as quickly as you need. Or call us free today to find out more 0800 774 0004.